maryland student loan tax credit application 2021

The state is offering up to 1000 in. At the bottom of the page you will find a heading called apply or.

Maryland S 1 000 Student Debt Relief Tax Credit How To Apply Deadline

When the student is awarded with.

. 2021 Update Canadian Debt Consolidation Plan Can. Credit for the repayment of eligible student loans. If the credit is more than the tax liability.

To be eligible for the tax credit Maryland residents must have incurred at least 20000 in student loan debt and have at least 5000 in outstanding student loan debt at the. Have incurred at least 20000 in undergraduate. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at.

How to apply for Marylands student loan debt relief tax credit. You must claim Maryland residency for the 2022 tax year. A copy of your maryland income tax return for the most recent prior tax year.

Since 2017 Marylands student loan debt relief tax credit has provided over 40 million to over 40000 Marylanders. If you live in Maryland you have only days left to apply for a tax credit to cover some of your student loans. Maintain Maryland residency for the 2021 tax year.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are. Complete the student loan debt relief tax credit application. To be eligible for the Student Loan Debt Relief Tax Credit you must.

Maryland taxpayers who have incurred at least. Comptroller Peter Franchot urges eligible Marylanders to act fast and apply for the Student Loan Debt Relief Tax Credit Program for Tax Year 2021. How much money is the Maryland Student Loan Debt Relief Tax Credit.

23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept. More than 40000 Marylanders have benefited from the tax credit since it. September 14 2022 757 pm.

Otherwise recipients may have to repay the credit. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Going to college may seem out of reach.

The credit amount is limited to the lesser of the individuals state tax liability for that year or the maximum allowable credit of 500. There isnt a set amount thats released for the.

Biden To Wipe Out 10 000 In Student Loan Debt For Many Borrowers Maryland Matters

Income Recertification Planning As Student Loan Freezes Ends

American Opportunity Tax Credit H R Block

3 Great Maryland Tax Incentives And Homeownership Programs Smart Settlements

Maryland Student Loan Forgiveness Programs

9m In More Tax Credits Available For Maryland Student Loan Debt

Maryland Student Loans Debt Statistics Student Loan Hero

State Local Tax Impacts Of Covid 19 For Maryland 2021 Forvis

Mackey S Financial Services Posts Facebook

Quick Guide Maryland Student Loan Debt Relief Tax Credit

What Is The Salt Tax Deduction Forbes Advisor

:max_bytes(150000):strip_icc()/Tax_Advantages_Buying_Home_Sketch-ffc74833ef7744f2ba7377009ff52274.png)

Top Tax Advantages Of Buying A Home

Mhec Student Loan Debt Relief Tax Credit Program For 2022 Apply By September 15th Eaglestone Tax Wealth Advisors

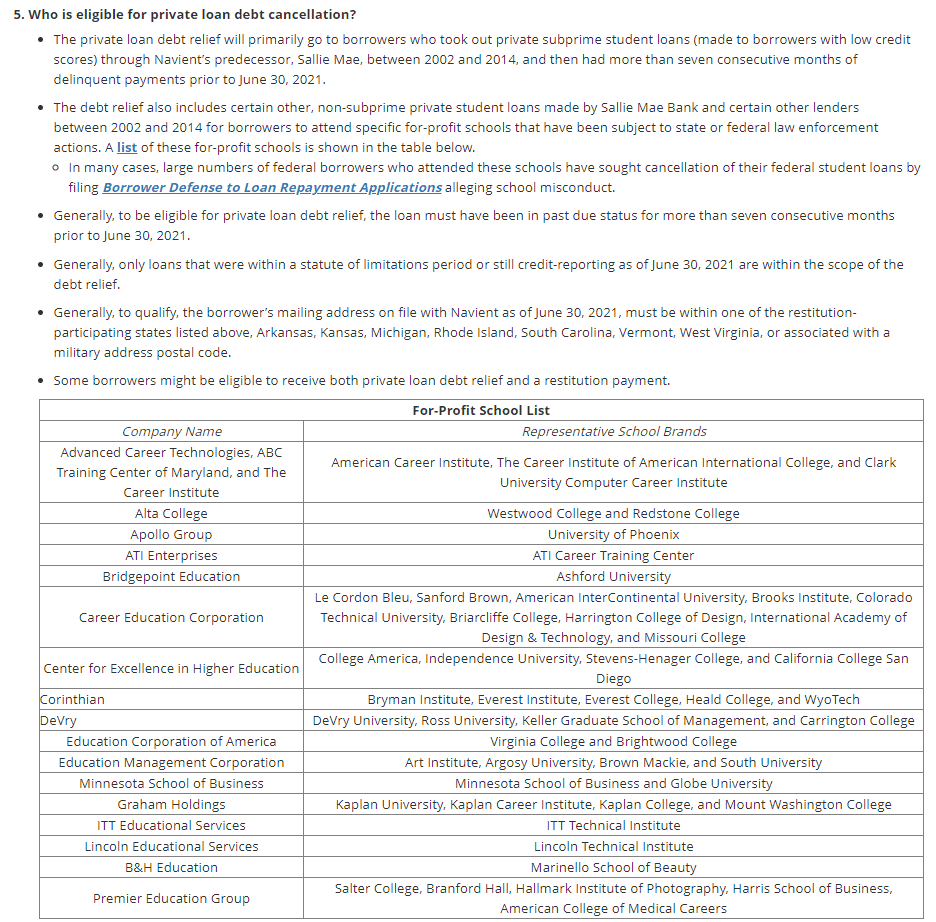

How To Get Navient Student Loan Forgiveness The Complete 2022 Guide

The Student Loan Forgiveness Application Is Live But Will You Owe Taxes On Debt Relief Cnet

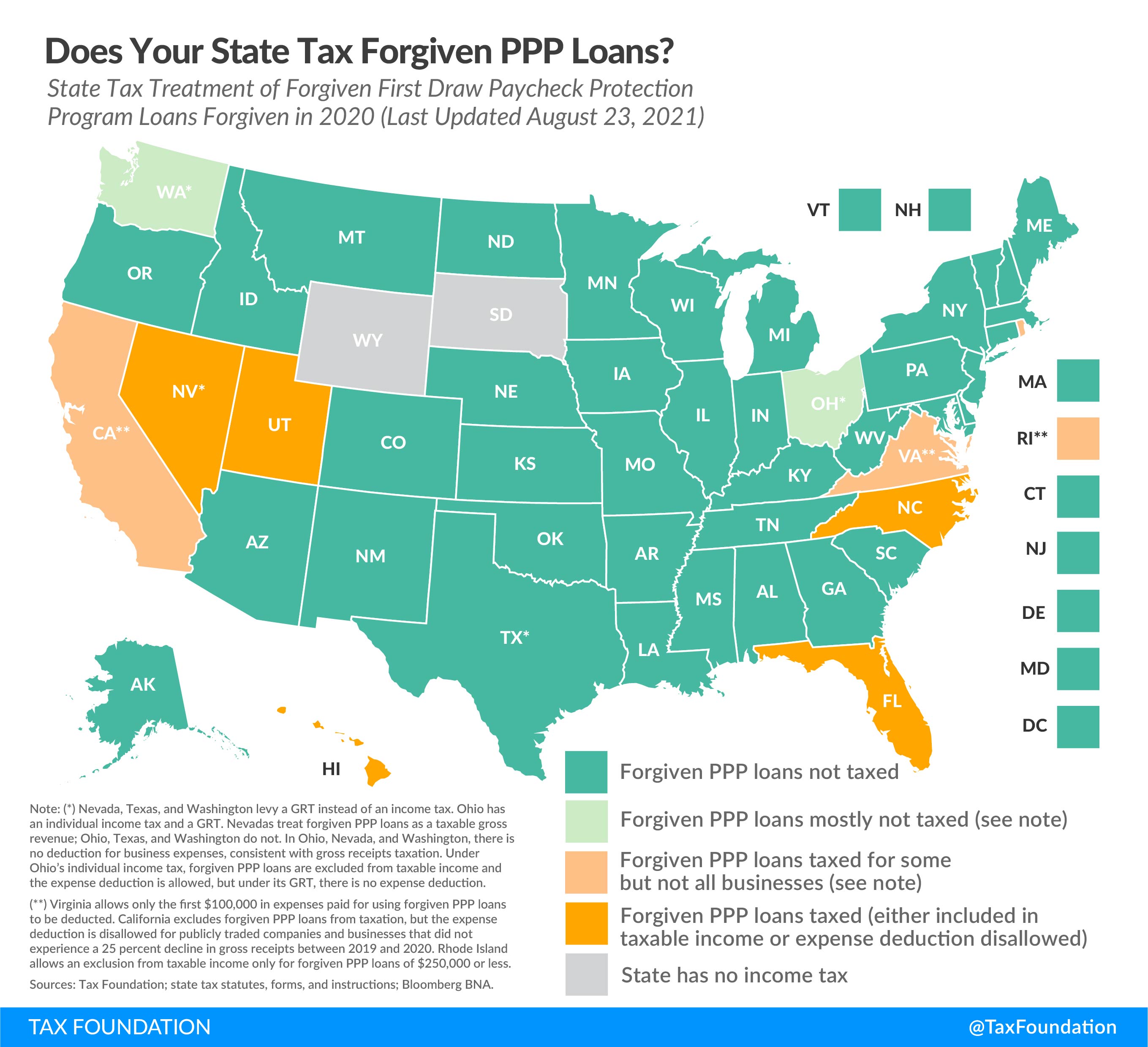

Ppp Loan Forgiveness Which States Are Taxing Forgiven Ppp Loans

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)

Form 5405 First Time Homebuyer Credit And Repayment Of The Credit

Can The Student Loan Interest Deduction Help You Citizens

Applications For Maryland Student Loan Debt Relief Due Sept 15